Do You Know Your FICO® Score?

A few years ago, my husband and I applied for a home equity line of credit (HELOC). We’d been watching our FICO® Score via one of our credit card statements. We knew that being in the 700s and 800s meant we should have no problem getting the HELOC.

We were wrong.

Note: The offers that appear on this blog contain affiliate links to Experian. Please visit my Privacy & Disclosure page for more detailed affiliate disclosure information.

Do You Know Your FICO® Score?

Though our FICO® Scores are quite good, the bank that we’d applied to for the HELOC had stricter rules about credit history than we anticipated. Banks are required to tell you why they reject you when they reject you. Our bank was no different.

Because of this requirement, we learned what the problem was. It said that a late payment on a credit card years ago was to blame.

Since we pay our credit cards in full every month, we were confused. So we headed over to FreeCreditReport.com, a part of Experian, to get our credit report.

The only way to see your credit history is to order a credit report. You can do this for free.

In case you’re not familiar with Experian, Experian provides online consumer credit reports, FICO® Scores, credit monitoring, and other credit-related information. FICO® Scores are used in most lending decisions when people apply for a new credit card, loan, mortgage, or, in our case, a HELOC.

Experian Free Credit Report

When we received our free Experian credit report, here’s what we discovered.

Save this article and we’ll send it to your inbox. Plus, we’ll send you more great links each week.

In May 2009 we missed one credit card payment. Every other month since May 2009 to now, there was an “OK” in the box. This “OK” on a credit report indicates that we’d paid every credit card on time. So one mistake one month years ago dinged us.

We should have ordered our free credit report sooner!

According to Experian negative payment histories are supposed to be deleted from your credit report after seven years. So why was this late payment still there? Because if you close a credit card (which we did with this one), that negative payment history can remain on your credit report for 10 years.

Lesson learned: even if you’re not using a credit card, keep the account open. Or if you know you had a negative mark on a credit card, make a note on your calendar to close the account 10 years later. In our case by June 2019 we had spotless credit again.

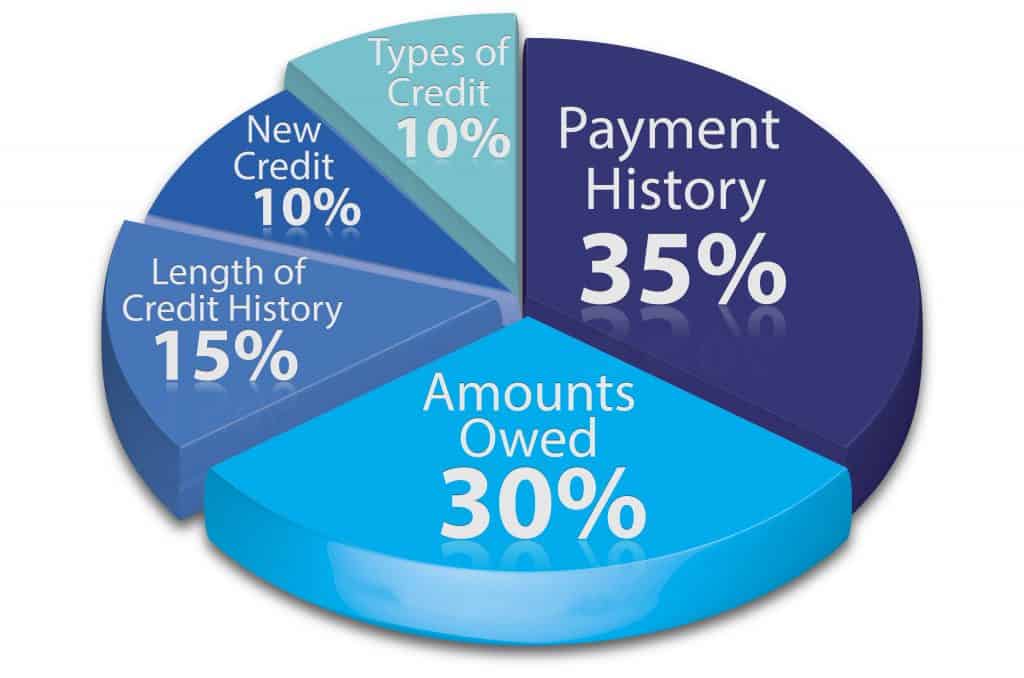

Utilization Rates

Another reason to keep credit card accounts open, even if you’re not using them: it can have a positive effect on your overall utilization rate. According to Experian this rate is the second most important thing that creditors look for when rating you as a customer. Basically, they want to see that you utilize your available credit in a responsible manner.

You also want to have a good balance-to-limit ratio on your debt. What is the balance-to-limit ratio? Whatever the balance of what you owe on loans, credit cards, your mortgage, etc., should be significantly lower than your credit limit.

If you have more open credit cards out there, you are seen as having a higher credit limit to offset your balances. It might seem crazy to have open credit cards you don’t use, but this explanation really does make sense.

If you’re worried about becoming more vulnerable to credit card fraud or identity theft, there is Experian’s Identity Theft Protection. Here’s what you get and how it works.

With Identity Theft Protection, you get 3-Bureau credit monitoring from Experian. It alerts you to key changes in your credit. That’s something you might miss on dormant credit card accounts that you might not be checking regularly.

Be Sure to Review Your Credit Report

When was the last time you reviewed your credit report? We have one credit card that reports our FICO® Score on our statement each month. But that’s just a number.

Getting our credit report through Experian provided a much more thorough review of our credit history. I’m talking pages and pages of information that the FICO® Score on our credit card statement never explained. We were able to access it immediately online.

Right now you can get your Experian Credit Report FREE at freecreditreport.com. There is no credit card required. If you’re worried that checking your credit report will hurt your score, don’t. Experian confirms that checking your own report doesn’t hurt your credit

Once you have signed up for your Free Experian Credit Report and realize that you would like to keep a closer eye on your Experian credit report over time, I would recommend checking out Experian $1 Trial – FICO® Score & Experian Report. You’ll receive your Experian Credit Report & FICO® Score for $1 with enrollment in a 7-day trial of Experian CreditWorks℠.

When you order your $1 Experian Credit Report and FICO® Score here, you will begin your 7-day trial membership in Experian CreditWorks℠. If you do not cancel your membership within the 7-day trial period, you will be billed $21.95 each month that you continue your membership. You may cancel your trial membership anytime within the trial period without charge.

Here’s what to do if another Equifax security breach happens.

Final thoughts on knowing your FICO® Score

If you have plans in the near future to apply for mortgage, a car loan, a college loan or anything else where your credit history will be searched, it’s important to know your FICO® Score. Even landlords and employers sometimes check an applicant’s credit history, and you need to know yours.

That’s why I think programs like Experian’s are so important for consumers to know about and use. If it hadn’t been for our Experian report, we never would have realized how that missed payment seven years ago, on a closed credit card, could harm our borrowing ability.

Do you know your credit history, your actual credit history? And your FICO® Score? If it’s been awhile, then definitely sign up for the $1 Experian Credit Report and FICO® Score.

Leah,

This article made me very confused. You’re are a frugal living blogger, but you write about your credit card payment and taking out a HELOC. May I ask what the HELOC is for? Dave Ramsey, Suze Orman, and others in the living within your means business would cringe that you have a credit card payment and HELOC and are write about being frugal.

I am not a financial expert, but I do know that having a credit card with a balance and taking out a HELOC are not frugal. May I suggest reevaluating what you consider frugal and contacting a financial expert to review your income and expenses to get your budget in order.

Please don’t consider this an attack on your writing, as I enjoy reading your articles. This particular article just actually made me concerned for your financial outlook.

Sincerely,

Simone Burch

Simone:

Thank you for your comment. I want to address some of the issues you raise as I’m not sure you read my piece closely.

We do NOT have a credit card with a balance. I wrote that we had a ding on our credit score from 7 years ago when we missed a single payment. In fact, I wrote, “Since we pay our credit cards in full every month, we were confused.” That continues to be true. We do live within our means as far as consumer debt is concerned.

Also, I did not explain why we were applying for a HELOC so let me do that now: we have two children in college. I believe that if you search advice from both Suze Orman and Dave Ramsay, they would recommend (paraphrased) that your children can borrow to pay for college but you can’t borrow to pay for retirement. Having promised our children we would help them pay for college, we are borrowing to help them pay so we could leave our retirement savings alone. One of the options for paying for college was the HELOC. Interest paid on home equity is tax deductible. But since we didn’t get the HELOC, it’s a moot point.

You’re right–I have positioned myself as a frugal-living blogger for years, and, to be honest, I’m going to be changing my approaching in the coming year. I’ll be sure to keep you and all my readers posted.

Thank you again for taking the time to post your comment. I always appreciate hearing from readers, and I hope you at least got some sort of take away from this piece.

Leah

Thanks for the response to my comment.

I did see that you pay your credit card off monthly, but then later in the article it stated you missed a payment inadvertently.

Looking forward to more of your posts and wish you luck with your upcoming changes to your blog.

We have had one in college and one currently in cosmetology school so I sympathize with the financial challenge. We were blessed that we were able to not take loans to send one to college. I am picking up extra shifts at work to try and pay cash for the second in cosmetology school.

Again, thanks for your response.

Happy writing! 🙂