Best Day to Grocery Shop

Did you know that there is a best day to grocery shop?

In fact, there is pretty much a best day to buy everything on your shopping list, including groceries.

At the same time, there is a best time of the year to buy certain products.

For example, I’ve written about how August is the best time of the year to buy a new car and how holiday weekends are usually the best days to buy new appliances.

When it comes to grocery shopping and buying other staples for your pantry, there are good days to buy groceries and bad days for buying.

Portions of this article originally appeared on Parade.com.

What is the Best Day to Grocery Shop?

If you belong to the millennial generation, you’ll be especially interested in these tips on the best days to grocery shop.

That’s because I’ve based these shopping tips on data from Ibotta, the app that gives you cash back for scanning store receipts and barcodes.

This information focuses on food items that millennials and hipsters tend to love.

Save this article and we’ll send it to your inbox. Plus, we’ll send you more great links each week.

I use Ibotta all the time to get cash back after food shopping at Costco, Walmart or Stop and Shop. You can also use Ibotta in lots of non-grocery purchases.

FYI, sign up for Ibotta through my link, and you’ll get $10 cash back.

Use Ibotta for non-grocery shopping, too

Ibotta works with retails like Joann Fabric, Kohl’s and even Amazon.

You can get cash back from Ibotta for wine and liquor purchases, too.

That’s good to know if you’re ever stocking up for holiday celebrations.

Once a year, Ibotta offers free wine and liquor.

That is, for Valentine’s Day or even Mother’s Day, there will be a cash-back offer for a spirits purchase you’ve made in a bar or restaurant.

I cover this in my blog post about free food offers. The image, below, shows one of those freebie offers.

Read my review on the Ibotta app to find out why I believe it is worth using every time you shop.

And if you haven’t yet, sign up today for Ibotta and download the browser extension.

Millennial Grocery Shopping Habits

But back to millennials, their shopping habits and how the information that Ibotta found can help save money when planning your holiday meals this year.

After analyzing more than 65 million purchases made since 2012, Ibotta wanted to identify the best days to save money on the items millennials love the most.

For example, when researchers compared the shopping behavior of various age groups, they found that millennials were buying wine at a higher clip than their generational counterparts.

Grocery shopping for wine

Overall, wine redemptions within the Ibotta app grew more than 80 percent over the last year alone.

Millennials purchase rosé 1.3 times more often than non-millennials.

The analysis identified the best days to save on rosé and other millennial items.

Scroll down to learn which days of the week are the best to buy groceries for all the millennial and hipster favorites.

This list ranges from rosé wine to avocados for avocado toast.

Note: You’ll quickly notice a trend—Sunday is a terrible day to go grocery shopping if you’re hoping to save money.

Millennial or not, this is good information to have.

Best Day to Grocery Shop for Quinoa

I love quinoa, a healthy, protein-packed substitute for rice as a side dish for so many meals that I make.

I usually buy quinoa in bulk from Costco.

You can also buy bulk quinoa from Amazon.

According to Ibotta, you want to be grocery shopping for quinoa on Thursday.

That’s the day that quinoa is 15 percent cheaper in the supermarket than on Monday.

So that makes Thursday the best day to buy quinoa.

Best Day to Buy Rosé

Watch out Pinot Grigio; millennials prefer pink rosé wine to any other variety.

So they’ll surely want to note that rosé is nine percent cheaper on Wednesday versus Tuesday, the worst day to buy.

That means it’s a good idea to plan for your weekend drinks earlier in the week.

So, when grocery shopping for wine, you want to stock up on Wednesday, the best day to buy rosé.

I’ve taken to buying my rosé at Trader Joe’s.

What was once know as two buck Chuck really isn’t that bad of a spirit after all.

Best Day to Buy Craft Beer

Everything tastes better when it is made in small batches, right?

The same is true with craft beer.

And as far as getting the best prices, craft beer is 14 percent cheaper on Thursday versus Sunday.

So that means that Thursday is the best day to grocery shop for craft beer.

You know what else millennials love besides craft beer?

Ordering their beer and wine and snacks from GoPuff.

Use this link and code GET20 for $10 off on your first two GoPuff orders.

Best Day to Grocery Shop for Hot Sauce

My husband is a fan of Buffalo chicken wings, served with hot sauce and blue cheese dressing.

So what day would I send him to the supermarket to save the most on hot sauce?

That would be on Friday or Saturday.

Friday and Saturday are the best days to grocery shop for hot sauce.

That’s when sriracha hot sauce is 11 percent cheaper than shopping on Sunday.

Looking for a gift for the hot sauce lover?

Check out this hot sauce subscription box available on Cratejoy.com.

Best Day to Buy Avocados

Avocados are, obviously, a staple for making guacamole and of a Super Bowl party menu.

They’re also a hipster favorite for avocado toast.

And, according to Ibotta, avocados are 25 percent cheaper on Wednesday vs. Sunday.

That makes Wednesday the best day to head to the grocery store to shop for avocados, and Sunday the worst day to buy them.

Best Day to Grocery Shop for Coffee

Clearly, I cover this in my blog post about free food offers.

National Coffee Day is the best day to buy coffee, because it’s often free.

But, what about the rest of the year?

Well, it turns out that coffee is eight percent cheaper at the grocery store on Wednesday.

It’s the most expensive on Sundays.

So Wednesday is the best day to buy coffee at the supermarket, and Sunday is the worst day to buy it.

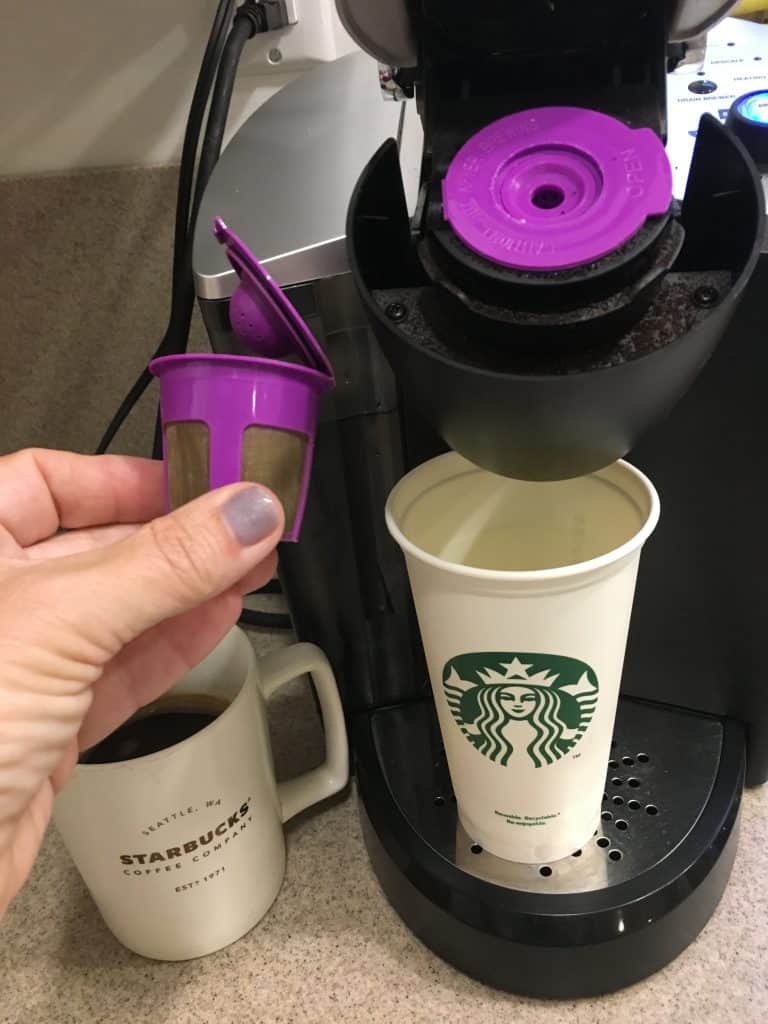

You know how I save money on my coffee in my Keurig coffee machine?

With these reusable coffee cups that I bought, on the cheap, on Amazon.

Best Day to Buy Kombucha

What is kombucha?

It is a fermented, sometimes fizzy drink made of green or black tea.

Many people believe it has health benefits.

Here’s what I believe, based on Ibotta data: Kombucha is 16 percent cheaper to buy on Wednesday, making Wednesday the best day to buy kombucha.

FYI, Tuesday is the worst day to buy it.

Worst day to grocery shop

If I’ve learned anything in writing this blog post it is this: do not grocery shop on Sundays anymore!

Clearly, it is not the best day to buy anything at the supermarket.

If you’d rather not go to the supermarket to grocery shop at all, here are dozens of food stores where you can buy groceries online.

Then you can pick up your order at the store or have it delivered.

Finally, here are some tips for grocery shopping on a shoestring budget.